Experience the Power of Cutting-Edge Technology with Sword & Shield Estate Planning

At Sword & Shield Estate Planning, we leverage the same advanced software utilized by leading estate planning attorneys. This powerful tool, designed and regularly updated by seasoned legal professionals, ensures our documents are always in line with the latest estate planning laws and fully compliant with all regulations.

What We Do

We are a document or form-based service provider. In short, we assist our clients in filling out forms, provide general legal information, opinions, or recommendations about possible legal rights, remedies, defenses, procedures, options, or strategies.

We do not give specific advice related to another’s facts or circumstances.

*I am not an attorney and I do not provide legal advice.

State-Specific Documentation:

Our software's ability to produce state-specific documents means we can provide personalized service tailored to your circumstances.

Unprecedented Savings: High Quality at Half the Cost

What sets us apart is our commitment to delivering exceptional value. With our advanced software, we can offer you the same high-quality, legally compliant estate planning documents, but at a fraction of the cost - typically about half or even less. At Sword & Shield Estate Planning, we believe that securing your future shouldn't break the bank. Let us help you safeguard your legacy with our cost-effective, state-of-the-art estate planning services.

Documents We Prepare

Wills, Trusts, Powers of Attorney, Health Care Directives, Certification of Trust, Individually or as a package

Complete Estate Plan: Individual and Couples - $995

Funded Revocable Living Trust

Pour-over Will

Certification of trust

Declaration of trust

Marital property agreement

Assignment of personal property

Distribution of personal property

Assignment of Business Interests

Wills and Guardianship

Powers of attorney

Health Care Directives

Final Instructions

Funding Instruction

Trust Funding process and checklist

Will and Powers Package: Individual and Couples - $495

Nomination of Guardian

Wills - Guardianship

Powers of attorney

Health care directives

Note: We do not provide consulting or legal advice

Our Story

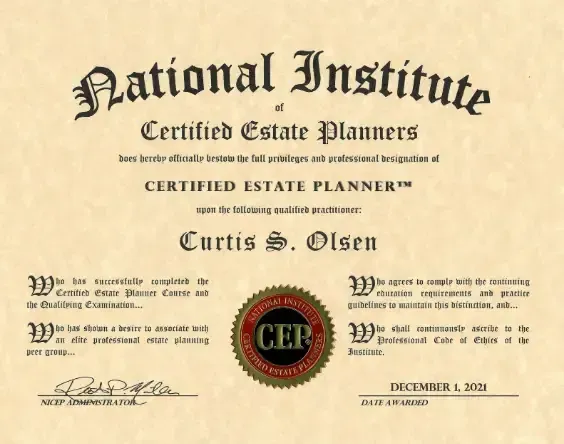

Unleash the Power of Strategic Financial Planning: A Journey Spanning Over Two Decades

With a rich legacy of 25 years in the financial services industry, our journey began in the dynamic world of residential mortgage lending. As we evolved, we expanded our expertise into the intricate realms of insurance planning and retirement strategizing, always staying ahead of the curve and delivering exceptional results.

A Personal Transformation: From Single Fatherhood to Estate

Planning Expert

Life has a way of reshaping our paths, and mine was no different. As a single father, I found myself at a crossroads, leading me to discover my true calling - Estate Planning. Over the past 15 years, I have had the privilege of guiding thousands of families, helping them protect their futures and secure

peace of mind.

A New Chapter: Personal Growth and Client Focus

Now, happily remarried to my soulmate, I am able to bring my best self to the table everyday. Her unwavering support allows me to remain laser-focused on addressing my clients' needs, ensuring their financial security and prosperity.

Your Future, Our Priority: Let's Begin the Conversation and complete your estate plan today.

Frequently Asked Questions - How The Process Works

Your Questions, Answered Clearly

What is estate planning, and why do I need it?

Estate planning: just mapping what happens to your money, house, kids-if you croak or can't think straight. Why need it? Without, chaos-probate court grabs control, fees skyrocket, heirs fight like cats, taxes eat chunks. With it? Wills, trusts, powers of attorney say: this goes here, doctor's orders from me, no drama. Saves cash, stress, time-think ten thousand bucks and months dodged. Life's messy; plan anyway. Want punchy copy? Estate Planning 101: Why Bother? It's your cheat sheet against disaster. Decide now-who gets grandma's china, who pays bills if you're vegetating, and how much Uncle Sam steals. Skip it? Probate eats five to ten percent, freezes accounts, and lets courts pick winners. With it? Wills, trusts, medical proxies-your call, your speed, your peace. Families, thank you later. Start simple: list assets, name guardians, sign stuff. Don

We need Estate Planning to avoid Probate

What Is Probate?

Probate is the court process that decides who gets a person’s property after they pass away. It’s the only legal way to transfer ownership of things that were in someone’s name alone — like a house, car, or bank account.

Because it’s handled through the courts, probate can be slow and expensive. According to AARP, it usually costs 3% to 10% of the estate’s value and can take anywhere from nine months to two years to finish.

The good news? Not everything you own has to go through probate.

Things like bank accounts, life insurance policies, and retirement plans (401(k)s, IRAs, pensions, annuities, etc.) can pass directly to your named beneficiary — as long as that person is alive, over 18, and capable.

But if beneficiaries aren’t listed or are out of date, or if you own real estate or investments in your name alone, those assets may still end up in probate.

Estate Planning options

Estate Planning: Three Real Choices-no sugarcoat. Option one: do jack squat. Your state writes the script-kids inherit half, spouse fights for scraps, probate drags forever, and the fees devour five to ten percent. Option two: will. You pick winners, the court still rubber-stamps, but challengers swarm-undue influence, fake signatures-lawsuits galore. Only twenty percent survive intact. Option three: trust. Stuff slides to heirs fast, quiet, cheap-two to five percent gone. Downside? Same drama creeps if Dad's marbles were lost that day he signed. Botched trusts flip right back to probate hell. So yeah-nothing, will, trust. All suck less than surprise, but pick wrong and everyone's crying in court. What's yours?

Doing Nothing

The Cost of Doing Nothing When you pass without a will, probate takes over. Here's what happens-your estate enters court, an executor is appointed, debts settled first. After that? State statute decides: spouse gets half or all, kids split the rest. But courts charge-from lawyer bills to filing fees-anywhere five to ten percent. And while that's ticking? Bank accounts freeze, houses sit empty, life's on hold. Oh, and if heirs disagree-brace for lawsuits. Don't gamble your family's future on later. Plan today.

Last Will and Testament

Having a Will: Better-but not bulletproof. Say goodbye without one last fight-if you're lucky. Executor you pick pays bills, follows your script: house to Susie, IRA to Jake, grandma's ring nowhere near Uncle Todd. Still, probate court signs off, freezes accounts until proven legit. Fees? Three to seven percent gone. And here's the kicker: anyone with standing-like that bitter cousin-can challenge it. Suddenly you're both dead AND on trial. A will's your weakest armor; trusts beat that. Think ahead.

Establishing a Trust

Dying with a Trust: Smarter, but Sneaky Risks Lurk. Trust beats probate-assets flow straight to heirs, no public circus, no year-long waits. House to the kids, stocks to charity, all quiet and quick. But watch: if Aunt Karen claims Dad was coerced or senile when he signed? Lawsuit city. Or fraud slips in-trust gets tossed, probate creeps back. Nearly a third of trusts spark family wars over influence or botched docs. No-contest clauses? They bite challengers without solid proof. Trusts shield, but cracks let lawsuits flood. Want ironclad peace? Update often, prove capacity, and lock it legally. Your legacy deserves armor. Go ahead and grab it!

How is Sword & Shield different from a traditional law firm?

We're not the courtroom cavalry-just the prep team. State-specific binders mean no last-minute gaps, no wasted trips to counsel. Think of us as the checklist before the big fight. Attorneys still get the glory; we just make sure you're loaded. Sword and Shield Estate Planning uses advanced proprietary software for highly personalized estate plans, setting us apart from traditional methods. Again, not legal advice-just talk to your own attorney.

Do I really need an attorney to create my estate plan?

Our advanced software makes estate planning a breeze for basic estate planning and beneficiaries-no attorney required for the basics. But complex trusts or major assets? Experts are non-negotiable to dodge pitfalls. Pro tip: Assess smart, act sharp..

What documents are included in an estate plan?

A typical plan may include:

- A Revocable Living Trust (if needed)

-A Last Will & Testament

- - Power of Attorney

- Advance Healthcare Directive / Living Will

- Guardianship Designations (for minor children)

We’ll help prepare the documents that fit your situation.

How much does it cost compared to hiring a lawyer?

We're charging solely for our software's powerhouse tools-like instant document creation, tailored templates, data encryption, and step-by-step guidance. No legal opinions, no attorney input; it's pure automation, cutting hours off your setup. This is 'Not a substitute for real advice.

Can I update my estate plan later if my situation changes?

Yes! Life changes — and your estate plan should too. If you move to a new state, have a child, get married, or experience any other major life event, we can help you update your documents quickly and affordably.

What are the steps in the process?

1. Kick off the no-sweat interview-just answer quick questions on assets, heirs, wishes.

2. Let our software crunch every detail.

3. Hit print-boom, your will, your trust, your plan.

How do I get started?

It’s simple: Twenty minutes of like bingeing on a Netflix short, except you're building your legacy. Every key detail covered. Get started now. Click the “Get Started Now” button, and you’ll be guided step-by-step through the process. Our team ensures your documents are accurate, compliant, and ready to protect what matters most.

Client Testimonials

FOLLOW US

ADDRESS

1198 S 3750 E, Spanish Fork,

UT 84660-6396, USA

CONTACT

HOURS

(Appointments during regular business hours)

© 2025 Sword and Shield Estate Planning All Rights Reserved. 1198 S 3750 E, Spanish Fork, UT 84660-6396. Contact Us. Terms of Service . Privacy Policy